# MI Reporting Data API Specification v3.1.5

- 1. Reporting Template Key Usage Instructions

- 2. Predefined Lists

- 3. Logical Data Dictionary

- 3.1 Performance and Availability (P & A)

- 3.1-A PSU Authentication & Interaction (OPTIONAL)

- 3.2 Response Outliers (OBIE)

- 3.3 Auth Efficacy (OBIE)

- 3.4 PSU Adoption (OBIE)

- 3.4-A Enhanced PSU Adoption (OBIE)

- 3.4-B PSU Consent Adoption (OBIE)

- 3.5 Payments Adoption (OBIE)

- 3.6 TPP Volumes (OBIE)

- 3.7 Daily Volumes (OBIE)

- 3.8 Additional Metrics (OBIE)

- 3.9 PSU Interface Performance and Availability (P & A)

- 4. Physical Data Dictionary

- 5. Example Reporting Template

- 6. Appendix

- 7. Version control

# 1. Reporting Template Key Usage Instructions

- ASPSPs must submit MI Data to OBIE using this template and as defined in the Read-Write API Reporting and MI SLA document.

- ASPSPs must populate the template using the API Endpoint IDs as defined in the section API Endpoint List.

- ASPSPs must populate the template using the ASPSP Brand IDs as defined in the section ASPSP Brand List.

- MI template for reporting required under OBIE is marked within brackets in the relevant tab names (1-9).

- ASPSPs must not submit any empty entries. NULL should always be populated in cells which are not relevant to an ASPSP's implementation MI.

- The Logical Data Dictionary for each field in the template file is defined below in section 3.

- Reported MI data in all Template tabs must exclude ASPSP test application data generated during ASPSPs testing own implementations.

- Note on reporting availability of endpoints: For endpoints to be reported as available, they need to be fully operational in terms of fulfilling their functionality and being able to respond back to the requesting TPP (i.e. no technical 5xx failures). However, this should exclude cases of network errors outside the ASPSP control or cases of TPPs becoming unavailable. For further details, please refer to section 1.1.

- For the avoidance of doubt, in tab 3. Auth Efficacy (OBIE), fields M (Confirmation Required), N (Confirmation Accepted by PSUs) and O (Confirmation Rejected by PSUs) relate only to journeys, when during authentication at the ASPSP, the PSU needs to select their payment account and/ or the ASPSP needs to provide supplementary information to the PSU. In these instances, the PSU would need to click 'confirm to complete the authentication journey, as per the journeys defined in the OBIE Customer Experience Guidelines CEGs. Thus, single journeys such as Refreshing AISP access and Single Domestic Payments – a/c selection @ PISP are excluded together with any other case where other journeys defined in the CEGs may be presented without any additional confirmation step.

- Version Reporting: Where ASPSPs support more than one major or minor API version in production, each version must be reported separately. For example, v3.0 and v3.1 must be reported separately. However patches, for example, v3.1.1, should be reported as aggregate together with the relevant major or minor release (i.e. together with v3.1). Note: Version reporting will not be mandatory for all the MI Reporting data. Please refer to each table in section 3 of the Data Dictionary for more details in terms of mandatory and optional version reporting.

- The template reflects the requirements in the MI Requirement for ASPSPs proposition paper MI Requirements v3.1.5 for ASPSPs - FINAL.

# 1.1 Unavailability Definition (Downtime)

# 1.1.1 Dedicated Interface Downtime

In alignment to the EBA Guidelines 2.2.b: "count the interface as ‘down’ when five consecutive requests for access to information for the provision of payment initiation services, account information services or confirmation of the availability of funds are not replied to within a total timeframe of 30 seconds, irrespective of whether these requests originate from one or multiple PISPs, AISPs or CBPIIs. In such a case, the ASPSP should calculate downtime from the moment it has received the first request in the series of five consecutive requests that were not replied to within 30 seconds, provided that there is no successful request in between those five requests to which a reply has been provided." In alignment to OBIE Operational Guidelines section 2.1.1: The clock for unavailability should start immediately after the first ‘failed’ request has been received within the 30-second timeframe. At a minimum, downtime should be measured if:

- Any ASPSP authorisation and/or resource server is not fully accessible and accepting all valid TPP requests as defined by EBA Guidelines 2.4c.

- Any ASPSP downstream system required to support these API endpoints is also not responding in a way which aaffectsthe availability of the ASPSP authorisation and/or resource servers.

- Any of the ASPSP screens and/or functionality of the PSU authentication flow is not available to enable PSUs to grant TPPs access to their account(s).

- This should include all 5xx errors.

- This should include both planned and unplanned downtime each day.

- Even if this only aaffectssome TPPs and/or PSUs, downtime should still be reported, i.e. partial downtime should still be measured as downtime.

- This should include any vendor/supplier failures in the case where the ASPSP has contracted the vendor/supplier to deliver a related service, e.g.

- the ASPSP's own hosting provider,

- any QTSP the ASPSP has selected for their own certificates,

- a third party directory service (e.g. the OBIE Directory).

However, this should exclude errors resulting from issues outside of the ASPSP's direct control, such as any of the following:

- Issues with TPP software, infrastructure or connectivity.

- Lack of response/availability from an individual QTSP resulting in the inability of the ASPSP to check the validity of a TPP's eIDAS certificate, since it is the TPP who has selected the QTSP.

The above guidelines relate only to how ASPSPs should calculate downtime. ASPSPs must be mindful of their own regulatory obligations under the PSD2 regulatory framework and eIDAS Regulation.

# 1.1.2 PSU Interface Downtime

In alignment to OBIE Operational Guidelines section Reporting for PSU Interfaces: "The total time in seconds for each day when any element of the PSU interface is not accessible by the PSU in the process of accessing their PSD2 in-scope account, and in order to access PSD2 functionality"

# 2. Predefined Lists

# 2.1 API Endpoint List

| EndpointID | Resource | Endpoint name | Service | Implementation Status | Category | Response Time Segment* |

|---|---|---|---|---|---|---|

| 0 | OIDC | OIDC endpoints for token IDs | OIDC | Mandatory | OIDC | Ta & Te |

| 1 | account-access-consents | POST /account-access-consents | AISP | Mandatory | Account Information - Account access Consent | Tb |

| 2 | account-access-consents | GET /account-access-consents/{ConsentId} | AISP | Mandatory | Account Information - Account access Consent | N/A |

| 3 | account-access-consents | DELETE /account-access-consents/{ConsentId} | AISP | Mandatory | Account Information - Account access Consent | N/A |

| 4 | accounts | GET /accounts | AISP | Mandatory | Account Information - Account | Tf |

| 5 | accounts | GET /accounts/{AccountId} | AISP | Mandatory | Account Information -Accounts | Tg |

| 6 | balances | GET /accounts/{AccountId}/balances | AISP | Mandatory | Account Information -Balances | Tg |

| 7 | balances | GET /balances | AISP | Optional | Account Information -Balances | Tg |

| 8 | transactions | GET /accounts/{AccountId}/transactions | AISP | Mandatory | Account Information -Transactions | Tg |

| 9 | transactions | GET /transactions | AISP | Optional | Account Information -Transactions | Tg |

| 10 | beneficiaries | GET /accounts/{AccountId}/beneficiaries | AISP | Conditional | Account Information -Beneficiaries | Tg |

| 11 | beneficiaries | GET /beneficiaries | AISP | Optional | Account Information -Beneficiaries | Tg |

| 12 | direct-debits | GET /accounts/{AccountId}/direct-debits | AISP | Conditional | Account Information -Direct Debits | Tg |

| 13 | direct-debits | GET /direct-debits | AISP | Optional | Account Information -Direct Debits | Tg |

| 14 | standing-orders | GET /accounts/{AccountId}/standing-orders | AISP | Conditional | Account Information -Standing Orders | Tg |

| 15 | standing-orders | GET /standing-orders | AISP | Optional | Account Information -Standing Orders | Tg |

| 16 | products | GET /accounts/{AccountId}/product | AISP | Conditional | Account Information - Product | Tg |

| 17 | products | GET /products | AISP | Optional | Account Information -Products | Tg |

| 18 | offers | GET /accounts/{AccountId}/offers | AISP | Conditional | Account Information - Offers | Tg |

| 19 | offers | GET /offers | AISP | Optional | Account Information - Offers | Tg |

| 20 | party | GET /accounts/{AccountId}/party | AISP | Conditional | Account Information - Party | Tg |

| 21 | party | GET /party | AISP | Conditional | Account Information - Party | Tg |

| 22 | scheduled-payments | GET /accounts/{AccountId}/scheduled-payments | AISP | Conditional | Account Information - Scheduled Payments | Tg |

| 23 | scheduled-payments | GET /scheduled-payments | AISP | Optional | Account Information - Scheduled Payments | Tg |

| 24 | statements | GET /accounts/{AccountId}/statements | AISP | Conditional | Account Information - Statements | Tg |

| 25 | statements | GET /accounts/{AccountId}/statements/{StatementId} | AISP | Conditional | Account Information - Statements | Tg |

| 26 | statements | GET /accounts/{AccountId}/statements/{StatementId}/file | AISP | Optional | Account Information - Statements | Tg |

| 27 | statements | GET /accounts/{AccountId}/statements/{StatementId}/transactions | AISP | Conditional | Account Information - Statements | Tg |

| 28 | statements | GET /statements | AISP | Optional | Account Information - Statements | Tg |

| 29 | domestic-payment-consents | POST /domestic-payment-consents | PISP | Mandatory | Payments - Single Domestic Payment | Tb |

| 30 | domestic-payment-consents | GET /domestic-payment-consents/{ConsentId} | PISP | Mandatory | Payments - Single Domestic Payment | N/A |

| 31 | domestic-payments | POST /domestic-payments | PISP | Mandatory | Payments - Single Domestic Payment | Tg |

| 32 | domestic-payments | GET /domestic-payments/{DomesticPaymentId} | PISP | Mandatory | Payments - Single Domestic Payment | Th |

| 33 | domestic-scheduled-payment-consents | POST /domestic-scheduled-payment-consents | PISP | Conditional | Payments - Future Dated Domestic Payment | Tb |

| 34 | domestic-scheduled-payment-consents | GET /domestic-scheduled-payment-consents/{ConsentId} | PISP | Mandatory (if resource POST implemented) | Payments - Future Dated Domestic Payment | N/A |

| 35 | domestic-scheduled-payments | POST /domestic-scheduled-payments | PISP | Conditional | Payments - Future Dated Domestic Payment | Tg |

| 36 | domestic-scheduled-payments | GET /domestic-scheduled-payments/{DomesticScheduledPaymentId} | PISP | Mandatory (if resource POST implemented) | Payments - Future Dated Domestic Payment | Th |

| 37 | domestic-standing-order-consents | POST /domestic-standing-order-consents | PISP | Conditional | Payments - Domestic Standing Order | Tb |

| 38 | domestic-standing-order-consents | GET /domestic-standing-order-consents/{ConsentId} | PISP | Mandatory (if resource POST implemented) | Payments - Domestic Standing Order | N/A |

| 39 | domestic-standing-orders | POST /domestic-standing-orders | PISP | Conditional | Payments - Domestic Standing Order | Tg |

| 40 | domestic-standing-orders | GET /domestic-standing-orders/{DomesticStandingOrderId} | PISP | Mandatory (if resource POST implemented) | Payments - Domestic Standing Order | Th |

| 41 | international-payment-consents | POST /international-payment-consents | PISP | Conditional | Payments - International Payments | Tb |

| 42 | international-payment-consents | GET /international-payment-consents/{ConsentId} | PISP | Mandatory (if resource POST implemented) | Payments - International Payments | N/A |

| 43 | international-payments | POST /international-payments | PISP | Conditional | Payments - International Payments | Tg |

| 44 | international-payments | GET /international-payments/{InternationalPaymentId} | PISP | Mandatory (if resource POST implemented) | Payments - International Payments | Th |

| 45 | international-scheduled-payment-consents | POST /international-scheduled-payment-consents | PISP | Conditional | Payments - International Scheduled Payments | Tb |

| 46 | international-scheduled-payment-consents | GET /international-scheduled-payment-consents/{ConsentId} | PISP | Mandatory (if resource POST implemented) | Payments - International Scheduled Payments | N/A |

| 47 | international-scheduled-payments | POST /international-scheduled-payments | PISP | Conditional | Payments - International Scheduled Payments | Tg |

| 48 | international-scheduled-payments | GET /international-scheduled-payments/{InternationalScheduledPaymentId} | PISP | Mandatory (if resource POST implemented) | Payments - International Scheduled Payments | Th |

| 49 | international-standing-order-consents | POST /international-standing-order-consents | PISP | Conditional | Payments - International Standing Order | Tb |

| 50 | international-standing-order-consents | GET /international-standing-order-consents/{ConsentId} | PISP | Mandatory (if resource POST implemented) | Payments - International Standing Order | N/A |

| 51 | international-standing-orders | POST /international-standing-orders | PISP | Conditional | Payments - International Standing Order | Tg |

| 52 | international-standing-orders | GET /international-standing-orders/{InternationalStandingOrderPaymentId} | PISP | Mandatory (if resource POST implemented) | Payments - International Standing Order | Th |

| 53 | file-payment-consents | POST /file-payment-consents | PISP | Conditional | Payments - Bulk/Batch Payments | Tb |

| 54 | file-payment-consents | GET /file-payment-consents/{ConsentId} | PISP | Conditional | Payments - Bulk/Batch Payments | N/A |

| 55 | file-payment-consents | POST /file-payment-consents/{ConsentId}/file | PISP | Mandatory (if resource POST implemented) | Payments - Bulk/Batch Payments | Tb |

| 56 | file-payment-consents | GET /file-payment-consents/{ConsentId}/file | PISP | Conditional | Payments - Bulk/Batch Payments | N/A |

| 57 | file-payments | POST /file-payments | PISP | Conditional | Payments - Bulk/Batch Payments | Tg |

| 58 | file-payments | GET /file-payments/{FilePaymentId} | PISP | Mandatory (if resource POST implemented) | Payments - Bulk/Batch Payments | Th |

| 59 | file-payments | GET /file-payments/{FilePaymentId}/report-file | PISP | Conditional | Payments - Bulk/Batch Payments | Th |

| 60 | funds-confirmation-consent | POST /funds-confirmation-consents | CoF | Mandatory | CBPII - Confirmation of Funds | Tb |

| 61 | funds-confirmation-consent | GET /funds-confirmation-consents/{ConsentId} | CoF | Mandatory | CBPII - Confirmation of Funds | N/A |

| 62 | funds-confirmation-consent | DELETE /funds-confirmation-consents/{ConsentId} | CoF | Mandatory | CBPII - Confirmation of Funds | N/A |

| 63 | funds-confirmation | POST /funds-confirmations | CoF | Mandatory | CBPII - Confirmation of Funds | Tf |

| 64 | payments | POST /payments | PIS | Mandatory | Payments - Single Domestic Payment | Tb |

| 65 | payments | GET /payments/{PaymentId} | PIS | Optional | Payments - Single Domestic Payment | N/A |

| 66 | payment-submissions | POST /payment-submissions | PIS | Mandatory | Payments - Single Domestic Payment | Tg |

| 67 | payment-submissions | GET /payment-submissions/{PaymentSubmissionId} | PIS | Optional | Payments - Single Domestic Payment | Th |

| 68 | account-requests | POST /account-requests | AIS | Mandatory | Account Information - Account access Consent | Tb |

| 69 | account-requests | GET /account-requests/{AccountRequestId} | AIS | Optional | Account Information - Account access Consent | N/A |

| 70 | account-requests | DELETE /account-requests/{AccountRequestId} | AIS | Mandatory | Account Information - Account access Consent | N/A |

| 71 | Callback-url | POST /callback-urls | Notifications | Optional | Notifications - Call Back | N/A |

| 72 | Callback-url | GET /callback-urls | Notifications | Mandatory (if resource POST implemented) | Notifications - Call Back | N/A |

| 73 | Callback-url | PUT /callback-urls/{CallbackUrlId} | Notifications | Mandatory (if resource POST implemented) | Notifications - Call Back | N/A |

| 74 | Callback-url | DELETE /callback-urls/{CallbackUrlId} | Notifications | Mandatory (if resource POST implemented) | Notifications - Call Back | N/A |

| 75 | domestic-payment-consents | GET /domestic-payment-consents/{ConsentId}/funds-confirmation | CoF | Mandatory | Payments - Confirmation of Funds | Tf |

| 76 | international-payment-consents | GET /international-payment-consents/{ConsentId}/funds-confirmation | CoF | Mandatory (if resource POST implemented) | Payments - Confirmation of Funds | Tf |

| 77 | international-scheduled-payment-consents | GET /international-scheduled-payment-consents/{ConsentId}/funds-confirmation | CoF | Mandatory (if immediate debit supported) | Payments - Confirmation of Funds | Tf |

| 78 | party | GET /accounts/{AccountId}/parties | AISP | Conditional | Account Information - Party | Tg |

| 79 | domestic-payments | GET /domestic-payments/{DomesticPaymentId}/payment-details | PISP | Optional | Payments - Single Domestic Payment | Th |

| 80 | domestic-scheduled-payments | GET /domestic-scheduled-payments/{DomesticScheduledPaymentId}/payment-details | PISP | Optional | Payments - Future Dated Domestic Payment | Th |

| 81 | domestic-standing-orders | GET /domestic-standing-orders/{DomesticStandingOrderId}/payment-details | PISP | Optional | Payments - Domestic Standing Order | Th |

| 82 | international-payments | GET /international-payments/{InternationalPaymentId}/payment-details | PISP | Optional | Payments - International Payments | Th |

| 83 | international-scheduled-payments | GET /international-scheduled-payments/{InternationalScheduledPaymentId}/payment-details | PISP | Optional | Payments - International Scheduled Payments | Th |

| 84 | international-standing-orders | GET /international-standing-orders/{InternationalStandingOrderPaymentId}/payment-details | PISP | Optional | Payments - International Standing Order | Th |

| 85 | file-payments | GET /file-payments/{FilePaymentId}/payment-details | PISP | Optional | Payments - Bulk/Batch Payments | Th |

| 86 | Event Notification Subscriptions | POST /event-subscriptions | Notifications | Optional | Notifications - Events | N/A |

| 87 | Event Notification Subscriptions | GET /event-subscriptions | Notifications | Mandatory (if resource POST implemented) | Notifications - Events | N/A |

| 88 | Event Notification Subscriptions | PUT /event-subscriptions/{EventSubscriptionId} | Notifications | Mandatory (if resource POST implemented) | Notifications - Events | N/A |

| 89 | Event Notification Subscriptions | DELETE /event-subscriptions/{EventSubscriptionId} | Notifications | Mandatory (if resource POST implemented) | Notifications - Events | N/A |

| 90 | Real-time Event Notifications | POST /event-notifications | Notifications | Optional | Notifications - Real-Time | N/A |

| 91 | Aggregated Polling Notifications | POST /events | Notifications | Optional | Notifications - Aggregated Polling | N/A |

| 92 | Authorization code** | Generated OIDC Authorisation code (virtual endpoint) | OIDC | N/A | OIDC | Td |

| 9999 | Other Endpoint code | Other Endpoint code | General | N/A | N/A | N/A |

Endpoint ID 9999 allows stakeholders to publish any new endpoint which is not available in the above list. The Other Endpoint block will be used for this purpose.

Note: Using the Endpoint ID and the OBIE Standards version in the reporting tables, provides a unique identifier for each of the reported endpoints of the ASPSPs' implementation.

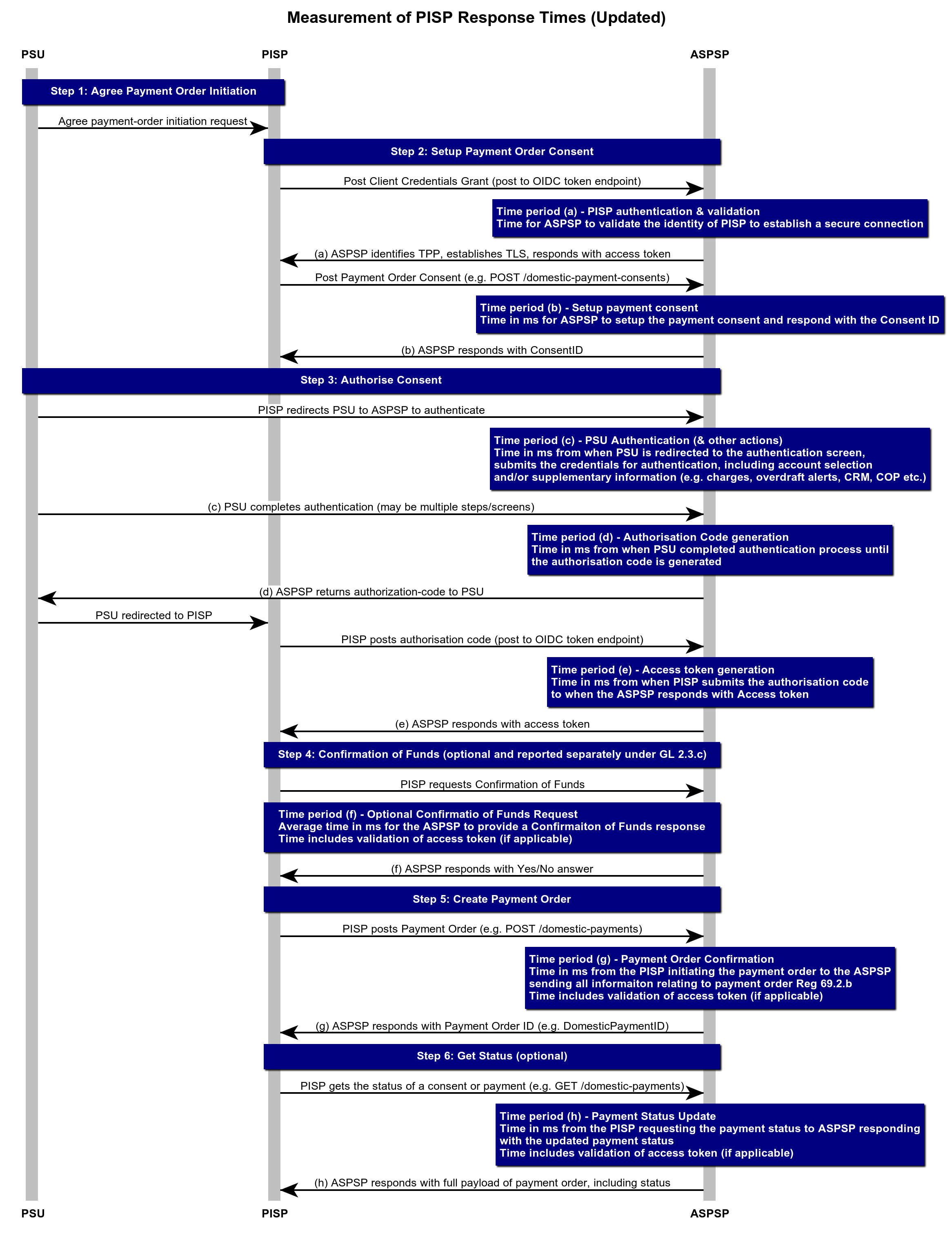

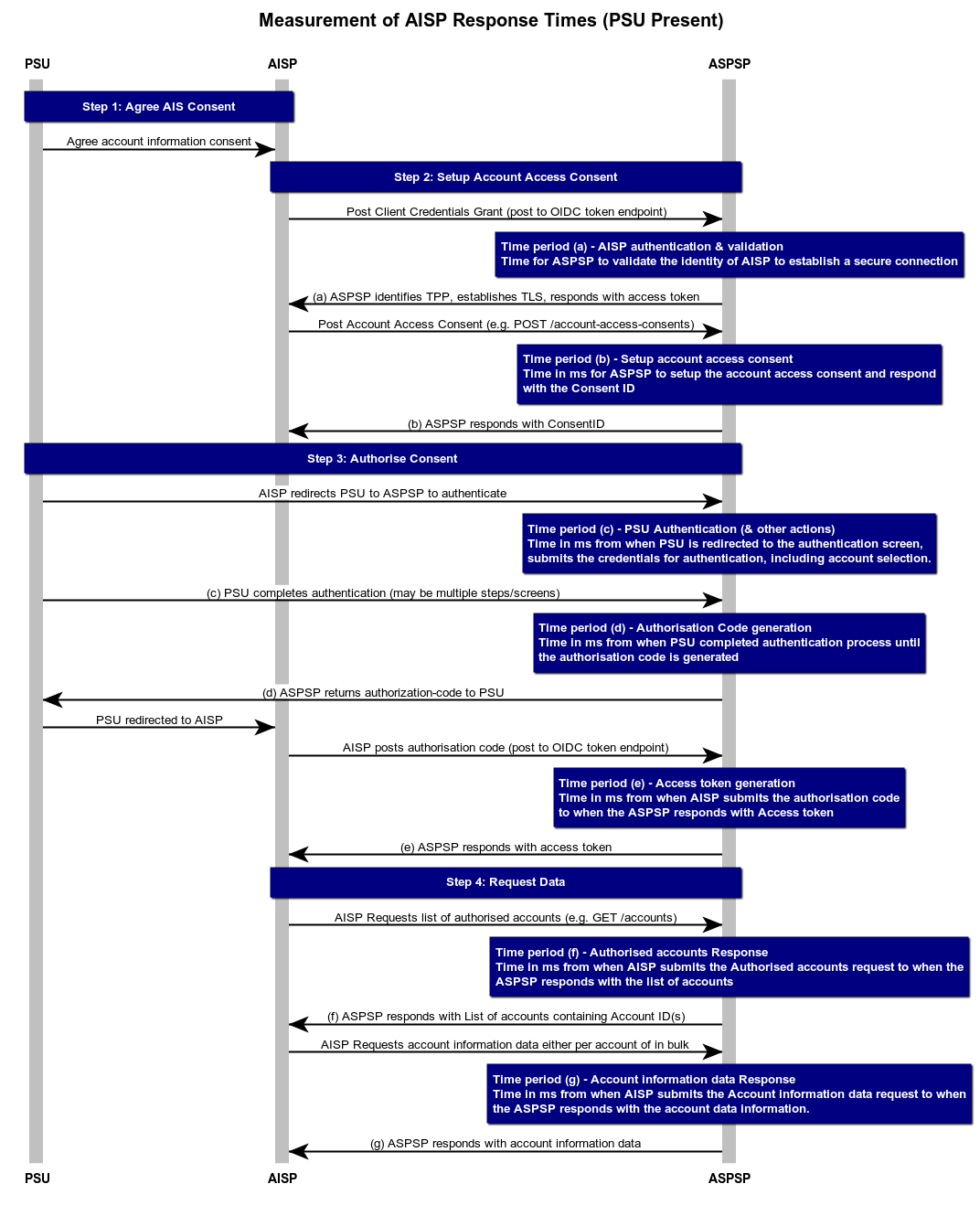

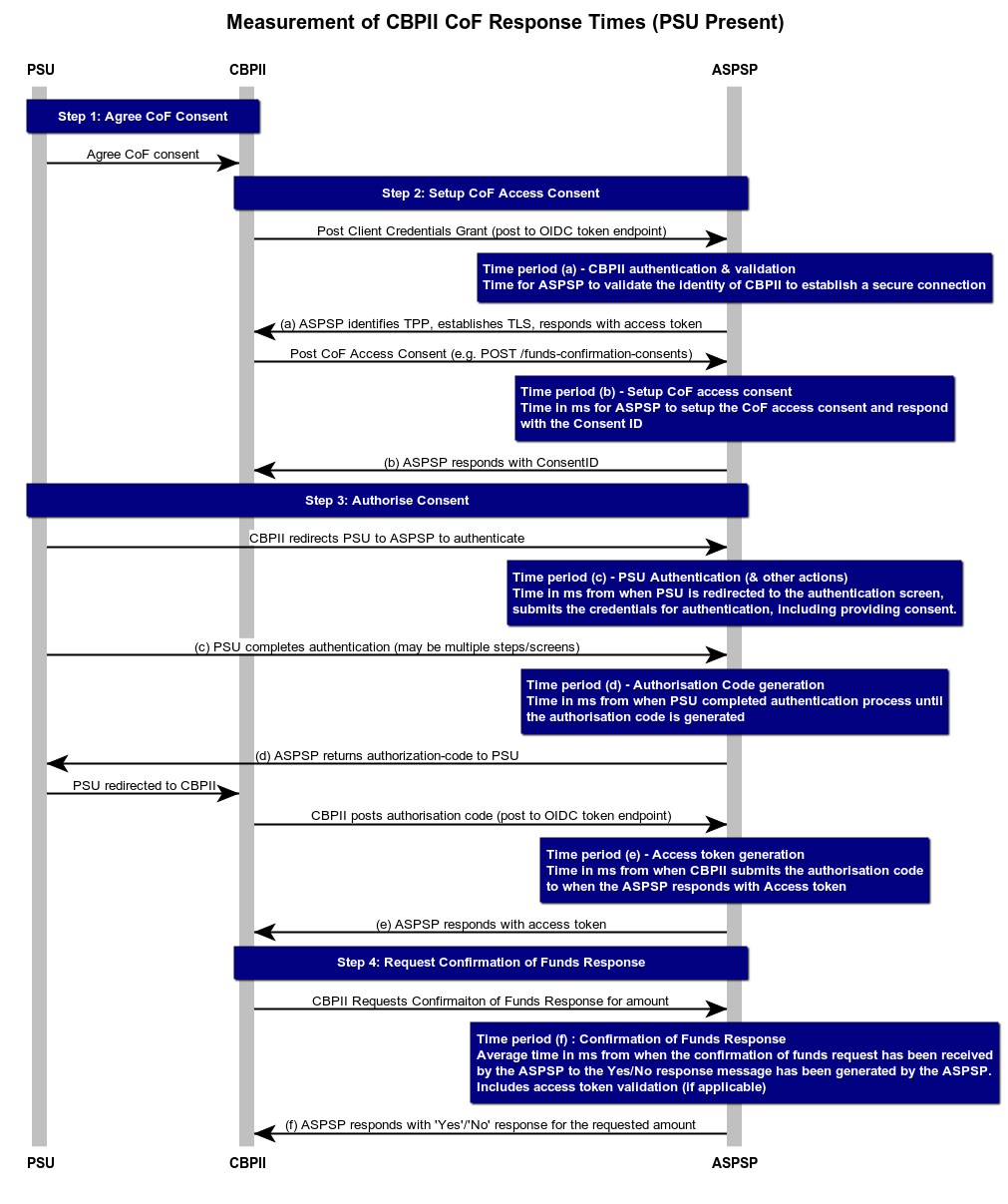

(*) For the definitions and more details on the time segments, please refer to section5.1 Measuring Performance for AISP, PISP and CBPII.

(**) This is not a real OIDC endpoint as such, but it is simply an entry (a virtual endpoint) to be used for measuring the time period (Td) of the authorisation code generation by ASPSPs. For more details, please refer to section 5.1 Measuring Performance for AISP, PISP and CBPII.

# 2.2. ASPSP Brand List

Note: The below list will be dynamic and will be amended as new ASPSPs and Brands are introduced. New entries will be added at the end of the list, so existing IDs are not expected to change.

| ASPSP Brand ID | ASPSP Brand Name |

|---|---|

| 1 | AIB First Trust Bank |

| 2 | AIB Group (UK) p.l.c. |

| 3 | Bank of Ireland UK |

| 4 | Bank of Scotland |

| 5 | Barclays |

| 6 | Danske Bank |

| 7 | First Direct |

| 8 | Halifax |

| 9 | HSBC |

| 10 | Lloyds |

| 11 | M&S Bank |

| 12 | Nationwide Building Society |

| 13 | Natwest |

| 14 | RBS |

| 15 | Santander UK plc |

| 16 | UBN |

| 17 | HSBC Business |

| 18 | MBNA |

| 19 | Bó |

| 20 | HSBC Kinetic |

| 21 | Cater Allen |

| 9999 | Other Brand code |

ASPSP Brand ID 9999 allows stakeholders to publish any new Brand which is not available in the above list. The Other Brand block will be used for this purpose.

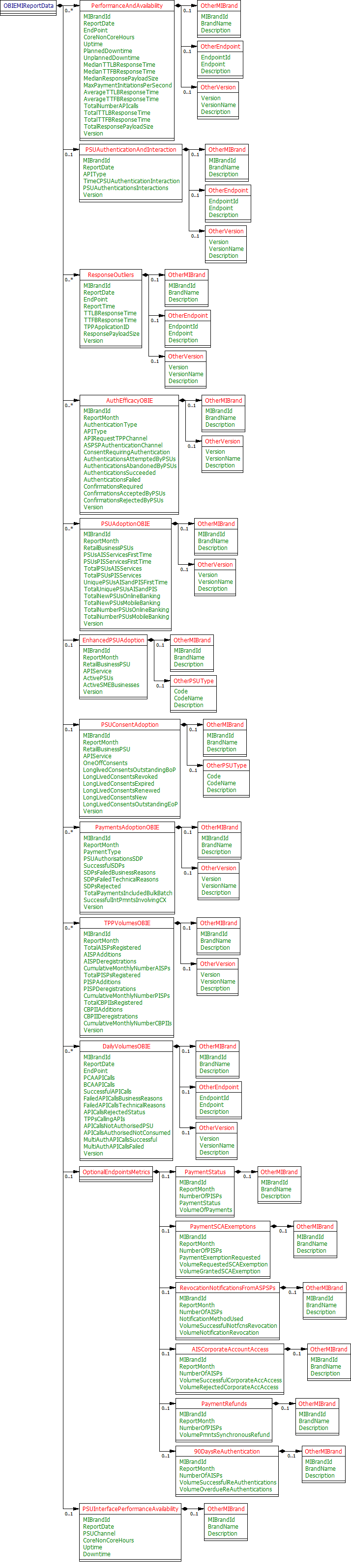

# 3. Logical Data Dictionary

The following tables are the Logical Data Dictionary explaining the fields in the MI Reporting Template.

# 3.1 Performance and Availability (P & A)

TAB: 1. P & A (OBIE)

| ID | Field Name | Description/Definition | DataType | Occurrence | Pattern | Format/Values/Comments |

|---|---|---|---|---|---|---|

| 1 | ReportDate | The reported date for each calendar day | ISODate | Mandatory | A particular point in the progression of time in a calendar year expressed in the YYYY-MM-DD format. This representation is defined in "XML Schema Part 2: Datatypes Second Edition - W3C Recommendation 28 October 2004" which is aligned with ISO 8601. | |

| 2 | ASPSP Brand ID | Reporting ASPSP Brand ID as defined in section 2.2. ASPSP Brand List. | Number | Mandatory | An integer value in range 1-9999. Will be extended as new Brands join Open Banking | |

| 3 | Endpoint ID | Reported EndPoint ID as defined in section 2.1 API Endpoint List. Note: ASPSPs must only report endpoints that have gone live in their systems. | Number | Mandatory | An integer value in range 1-9999. Will be extended as new endpoints are being implemented by Open Banking future standards. | |

| 4 | Core/Non-Core Hours (8.4/8.5) | Used for reporting the availability and performance of each individual endpoint during core hours (06.00-0.00) and non-core hours (0.00-06.00) of each calendar day | Max40Text | Mandatory | Allowed enumeration values: - Core Hours (06.00 - 00.00) - Non-Core Hours (00.00 - 06.00) | |

| 5 | Uptime (8.4/8.5) | Uptime per each individual endpoint in hours and minutes. (Elapsed time) Note on reporting availability of endpoints: For endpoints to be reported as available (uptime), they need to be fully operational in terms of fulfilling their functionality and being able to respond back to the requesting TPP (i.e. no technical 5xx failures). However, this should exclude cases of network errors outside the ASPSP control or cases of TPPs becoming unavailable. For further details, please refer to section 1.1.1 Total uptime is calculated as: 1. Core Hours: Uptime = Total number of core hours (18:00) - Total Planned Downtime (hh:mm) - Total Unplanned Downtime (hh:mm) 2. Non-Core Hours: Uptime = Total number of non-core hours (6:00) - Total Planned Downtime (hh:mm) - Total Unplanned Downtime (hh:mm) | Max5Text | Mandatory | ^[0-1][0-5]:[0-5][0-9]$ | Hours and seconds text in the following format: "hh: mm" Max value: A) Core Hours: 18:00, B) Non Core Hours: 06:00 Min value: A) Core Hours: 00:00, B) Non-Core Hours: 00:00 Conditions 1. Core Hours: Uptime + Planned Downtime + Unplanned Downtime = 18 hours 2. Non-Core Hours: Uptime + Planned Downtime + Unplanned Downtime = 6 hours |

| 6 | Planned Downtime (8.4/8.5) | Any planned duration that the API endpoints become unavailable. For the avoidance of doubt, this extends to include all systems that are required for the relevant endpoint to be fully functional (Refer to A. Guidelines item 9). The clock for unavailability should start immediately and consolidated duration must be reported during core hours and non-core hours, as elapsed time. Due to per-minute granularity, rounding is expected to take place to the nearest whole minute (e.g. 1 min 15 sec should be reported as 1 min, 1 min 40 sec should be reported as 2 min). For further details, please refer to section 1.1.1 | Max5Text | Mandatory | ^[0-1][0-5]:[0-5][0-9]$ | Hours and seconds text in the following format: "hh: mm" Conditions 1. Core Hours: Uptime + Planned Downtime + Unplanned Downtime = 18 hours 2. Non-Core Hours: Uptime + Planned Downtime + Unplanned Downtime = 6 hours |

| 7 | Unplanned Downtime (8.4/8.5) | Any unplanned duration that the API endpoints become unavailable due to technical faults or any other reasons. For the avoidance of doubt, this extends to include all systems that are required for the relevant endpoint to be fully functional (For further details, please refer to section 1.1.1). The clock for unavailability should start as defined in section 1.1.1 and consolidated duration must be reported during core hours and non-core hours, as elapsed time. Due to per-minute granularity, rounding is expected to take place to the nearest whole minute (e.g. 1 min 15 sec should be reported as 1 min, 1 min 40 sec should be reported as 2 min). | Max5Text | Mandatory | ^[0-1][0-5]:[0-5][0-9]$ | Hours and seconds text in the following format: "hh:mm" Conditions 1. Core Hours: Uptime + Planned Downtime + Unplanned Downtime = 18 hours 2. Non-Core Hours: Uptime + Planned Downtime + Unplanned Downtime = 6 hours |

| 8 | Median TTLB Response Time (Time to Last Byte) (8.6/8.7/8.8) | The median value across all values of Time to Last Byte (TTLB) response time for each API endpoint during the duration of core and non-core hours (e.g. a Get Account Transactions Request generates a Get Account Transactions Response message). Time to Last Byte (TTLB) is defined in the context of the OBIE reporting template as the total time taken for an API endpoint call to generate a response message and provide to AISPs, PISPs or CBPIIs all the information as required as defined in 36(1)(a), 36(1)(b), 36(1)(c) of the RTS and 66(4)(b), 65(3) of the PSD2. The response time clock should start at the point the endpoint call is fully received by the ASPSP and should stop at the point the last byte of the response message is transmitted to the AISP, PISP, or CBPII. For further clarifications on TTLB and TTFB, please refer to the Notes section at the end of the table. The response time must be reported in milliseconds as follows: 1. Core Hours: Median (TTLB response time of each endpoint call of a specific type between 06.00 and 0.00 excluding the endpoint downtime) 2. Non Core Hours: Median (TTLB response time of each endpoint call of a specific type between 00.00 and 06.00 excluding the endpoint downtime). If an endpoint is unavailable during the whole of the reported period, response time should be zero. | Number | Mandatory | Integer number with value >=0 Values in milliseconds Conditions 1. TTLB >= TTFB | |

| 9 | Median TTFB Response Time (Time to First Byte) (8.9) | The median value across all values of Time to First Byte (TTFB) response time for each API endpoint during the duration of core and non-core hours (e.g. a Get Account Transactions Request generates a Get Account Transactions Response message). Time to First Byte (TTFB) is defined in the context of the OBIE reporting template as the total time taken for an API endpoint call to generate a response message and start providing to AISPs, PISPs or CBPIIs all the information as required as defined in 36(1)(a), 36(1)(b), 36(1)(c) of the RTS and 66(4)(b), 65(3) of the PSD2. The response time clock should start at the point the endpoint call is fully received by the ASPSP and should stop at the point the first byte of the response message is transmitted to the AISP, PISP, or CBPII. For further clarifications on TTLB and TTFB, please refer to the Notes section at the end of the table. The response time must be reported in milliseconds as follows: 1. Core Hours: Median (TTFB response time of each endpoint call of a specific type between 06.00 and 0.00 excluding the endpoint downtime) 2. Non Core Hours: Median (TTFB response time of each endpoint call of a specific type between 00.00 and 06.00 excluding the endpoint downtime) If an endpoint is unavailable during the whole of the reported period, response time should be zero. | Number | Mandatory | Integer number with value >=0 Values in milliseconds Conditions 1. TTLB >= TTFB | |

| 10 | Median ResponsePayload Size (8.10) | The median value across all values of Response Payload for each API endpoint during the duration of core and non-core hours (e.g. a Get Account Transactions Request generates a Get Account Transactions Response message). The response payload size of the response message to each supported Read/Write API endpoints must also include the size of the message headers. The Response Payload must be reported in bytes as follows: 1. Core Hours: Median (Response payload of each endpoint call of a specific type between 06.00 and 0.00 excluding the endpoint downtime) 2. Non Core Hours: Median (Response payload of each endpoint call of a specific type between 00.00 and 06.00 excluding the endpoint downtime) If an endpoint is unavailable during the whole of the reported period, the response payload should be zero. | Number | Mandatory | Integer number with value >=0 Values in Bytes | |

| 11 | Max Payment Initiations Per Second (PIPS) (8.12) | This field is only applicable to PIS endpoints. For AIS and CBPII endpoints it should be populated with NULL. The maximum number of successful payment initiations per second (PIPS) for the payment order POST API calls during the duration of core and non-core hours. The PIPS must be reported as whole numbers as follows: 1. Core Hours: Max (number of payment initiation POST endpoint calls during the period of 1 sec, for all 1 second periods between 06.00 and 0.00 excluding the endpoint downtime) 1.Non-Core Hours: Max (number of payment initiation POST endpoint calls during the period of 1 sec, for all 1 second periods between 00.00 and 06.00 excluding the endpoint downtime) | Max4AlphaNumericText | Mandatory | Integer number Max value: 9999 Min value: 0 Not applicable: NULL | |

| 12 | Average TTLB Response Time (Time to Last Byte) | The average (mean) value across all values of Time to Last Byte (TTLB) response time for each API endpoint during the duration of core and non-core hours (e.g. a Get Account Transactions Request generates a Get Account Transactions Response message). Time to Last Byte (TTLB) is defined in the context of the OBIE reporting template as the total time taken for an API endpoint call to generate a response message and provide to AISPs, PISPs or CBPIIs all the information as required as defined in 36(1)(a), 36(1)(b), 36(1)(c) of the RTS and 66(4)(b), 65(3) of the PSD2. The response time clock should start at the point the endpoint call is fully received by the ASPSP and should stop at the point the last byte of the response message is transmitted to the AISP, PISP, or CBPII. The response time must be reported in milliseconds as follows: 1. Core Hours: Mean (TTLB response time of each endpoint call of a specific type between 06.00 and 0.00 excluding the endpoint downtime) 2. Non-Core Hours: Mean (TTLB response time of each endpoint call of a specific type between 00.00 and 06.00 excluding the endpoint downtime) If an endpoint is unavailable during the whole of the reported period, response time should be zero. | Number | Mandatory | Integer number with value >=0 Values in milliseconds Conditions 1. TTLB >= TTFB | |

| 13 | Average TTFB Response Time (Time to First Byte) | The average (mean) value across all values of Time to First Byte (TTFB) response time for each API endpoint during the duration of core and non-core hours (e.g. a Get Account Transactions Request generates a Get Account Transactions Response message). Time to First Byte (TTFB) is defined in the context of the OBIE reporting template as the total time taken for an API endpoint call to generate a response message and start providing to AISPs, PISPs or CBPIIs all the information as required as defined in 36(1)(a), 36(1)(b), 36(1)(c) of the RTS and 66(4)(b), 65(3) of the PSD2. The response time clock should start at the point the endpoint call is fully received by the ASPSP and should stop at the point the first byte of the response message is transmitted to the AISP, PISP, or CBPII. The response time must be reported in milliseconds as follows: 1. Core Hours: Mean (TTFB response time of each endpoint call of a specific type between 06.00 and 0.00 excluding the endpoint downtime) 2. Non-Core Hours: Mean (TTFB response time of each endpoint call of a specific type between 00.00 and 06.00 excluding the endpoint downtime) If an endpoint is unavailable during the whole of the reported period, response time should be zero. | Number | Mandatory | Integer number with value >=0 Values in milliseconds Conditions 1. TTLB >= TTFB | |

| 14 | Total Number of API calls | This is the total number of API calls per day per endpoint, per brand split by core/non-core. | Number | Mandatory | Integer number with value >=0 | |

| 15 | Total TTLB Response Time (Time to Last Byte) | This is the sum of all the TTLB responses of all endpoint calls of each endpoint type during the period of core hours or non-core hours. For the avoidance of doubt, this is the sum of all the TTLB response times generated by the Total Number of API calls for each endpoint. | Number | Mandatory | Integer number with value >=0 | |

| 16 | Total TTFB Response Time (Time to First Byte) | This is the sum of all the TTFB responses of all endpoint calls of each endpoint type during the period of core hours or non-core hours. For the avoidance of doubt, this is the sum of all the TTFB response times generated by the Total Number of API calls for each endpoint. | Number | Mandatory | Integer number with value >=0 | |

| 17 | Total ResponsePayload Size | This is the sum of the payload of all the response messages for all endpoint calls of each endpoint type during the period of core hours or non-core hours. For the avoidance of doubt, this is the sum of all the payloads of the response messages generated by the Total Number of API calls for each endpoint. | Number | Mandatory | Integer number with value >=0 | |

| 18 | Version | The OBIE Standards version of the endpoint implementation by the ASPSP, aggregated at the level of a major or minor release, as defined in item#10 of Section 1 key usage instructions. | Max40Text | Mandatory | Allowed enumeration values: v1.0, v1.1, v2.0, v3.0, v3.1,... |

Notes:

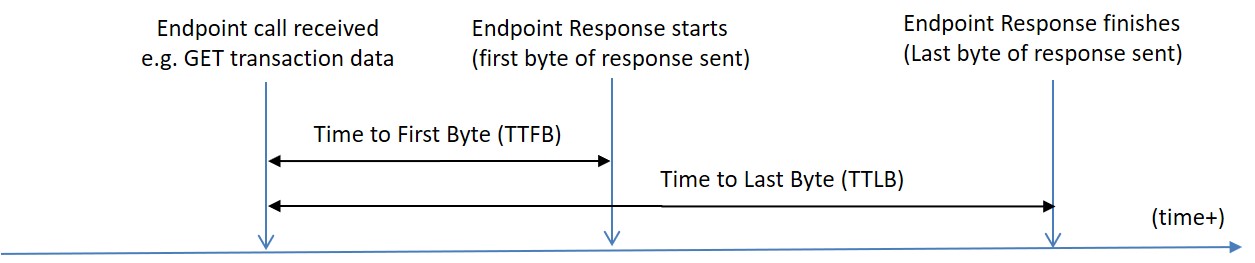

- Please refer to the diagram below for the difference between TTFB and TTLB.

While TTLB measures the full time taken for a response from an endpoint call to be provided back to the TPP (which may be subject to external network delays or delays in the TTPs' systems in receiving the data), TTFB is looking to measure the internal latency within each ASPSP.

Thus, TTFB provides the time taken for the ASPSP to fetch the required data from their internal downstream systems and make them available to be sent to the TPP via the ASPSP API gateway.

Please also note that:

- The TTFB timings may exclude the time taken by infrastructure, network devices and network infrastructure that is not part of the ASPSP’s infrastructure (e.g. DNS servers, ISP gateways etc.)

- The TTFB timing must not exclude the time taken by infrastructure, network devices and network infrastructure that is part of the ASPSP’s infrastructure (this includes but is not limited to devices such as firewalls, WAFs, SSL termination devices, load balancers, API gateway etc.)

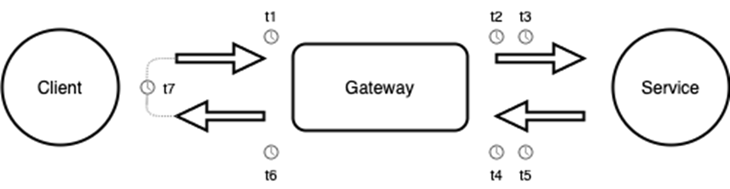

- For further clarifications, please refer to the following diagram (kindly provided by Barclays):

Definitions

Definitions

t1: The timestamp recorded when the request is initially received by the Gateway.

t2: The time when the request was initiated to the next available service.

t3: The time when the request write was started.

t4: The response time for each service.

t5: This is the read time for response content.

t6: The timestamp when the request write was initiated.

t7: The overall time taken between receipt of the incoming request and streaming of the complete response to the client.

Based on the above diagram and definitions:

TTLB = time period (t7) - (t1)

TTFB = time period (t6) - (t1)

Also the following holds: TTLB = TTFB + (t7)

# 3.1-A PSU Authentication & Interaction (OPTIONAL)

The reporting of the fields in the table below is Optional for ASPSPs.

TAB: 1-A. PSU Authentication & Interaction

| ID | Field Name | Description/Definition | DataType | Occurrence | Pattern | Format/Values/Comments |

|---|---|---|---|---|---|---|

| 1 | ReportDate | The reported date for each calendar day | ISODate | Optional | A particular point in the progression of time in a calendar year expressed in the YYYY-MM-DD format. This representation is defined in "XML Schema Part 2: Datatypes Second Edition - W3C Recommendation 28 October 2004" which is aligned with ISO 8601. | |

| 2 | ASPSP Brand ID | Reporting ASPSP Brand ID as defined in section 2.2. ASPSP Brand List. | Number | Optional | An integer value in range 1-9999. Will be extended as new Brands join Open Banking | |

| 3 | API Type | This is the type of OBIE services that are being reported for the PSU authentication and interaction timings. journey. It includes Account Information Services (AIS), Payment Initiation Services (PIS) and Card-Based Payment Instrument Issuers (CBPIIs). | Max40Text | Optional | Allowed enumeration values: - AIS - PIS - CBPII | |

| 4 | Time C PSU Authentication & Interaction (ms) (OPTIONAL) | This is the total Tc total time taken for all the PSU consent journeys during the duration of a reporting day. Each Tc time period is the time taken for the PSU to complete the authentication process. For the avoidance of doubt, this is the time measured in seconds from the point in time the PSU, after being redirected to the authentication screen of the ASPSP Authorisation Server, submits the credentials for authentication, completes authentication and any other actions (such as selecting accounts or providing consent), until control is passed back to the ASPSP to start the process of generating the authorisation code. More details, please refer to section 5.1 Measuring Performance for AISP, PISP and CBPII. | Number | Optional | A decimal number, with 2 decimal points granularity, with value >=0.00 | |

| 5 | PSU Authentications & Interactions Volumes (OPTIONAL) | This is the Vc, which is the total volume of PSU authentications that generated the total response time Tc total It is the total number of PSU consent journeys that generated PSU authentication during the duration of a reporting day. More details, please refer to section 5.1 Measuring Performance for AISP, PISP and CBPII. | Max20AlphaNumericTex | Optional | Integer number with value >=0 | |

| 6 | Version | The OBIE Standards version of the implementation by the ASPSP, aggregated at the level of a major or minor release, as defined in item#10 of Section 1 key usage instructions. The reporting of this item is optional. | Max40Text | Optional | Allowed enumeration values: v1.0, v1.1, v2.0, v3.0, v3.1,... |

# 3.2 Response Outliers (OBIE)

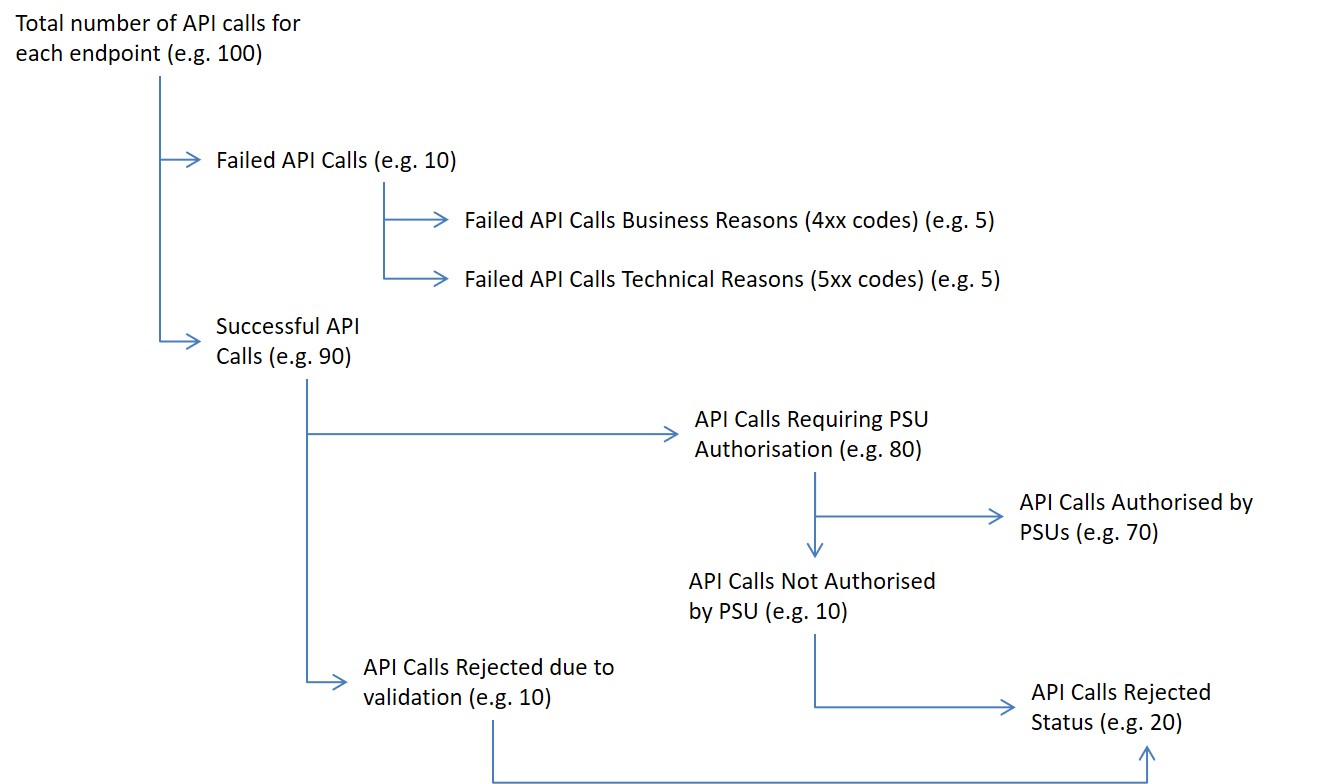

Outlier response time in the context of the OBIE reporting template is defined as the API endpoint with TTLB response time of value that qualifies to be included in the set of Slowest 50 of all endpoints during both Core Hours (06.00-0.00) and non-Core Hours (0.00-06.00) of the service and when the API endpoints are available. The Slowest 50 data set is the top 50 endpoints with the highest percentage of their TTLB response being greater than the median TTLB value for this endpoint for the day (i.e top 50 endpoints with the highest value for the delay ratio TTLB / median (TTLBs for the endpoint during the day the endpoint call happened). For the avoidance of doubt, calculations are as follows: During Core Hours:

- For each endpoint calculate delay ratio = TTLB/ (median TTLB of all endpoints calls for the endpoint type during core hours of the day the endpoint was called)

During non-Core Hours:

- For each endpoint calculate delay ratio = TTLB/ (median TTLB of all endpoint calls for the endpoint type during non-core hours of the day the endpoint was called)

Slowest 50 across all endpoints of all types for all hours (core and non-core) during the reporting period (i.e. one month) is the set of the 50 endpoints with the highest delay ratio from all the calculated delay ratio values during the reporting period. Note: OBIE will be reviewing the fixed number (i.e. 50) of outliers submitted as part of the above definition and maybe be fine-tuning this figure in future iterations of the Data Dictionary.

TAB: 2. Response Outliers (OBIE)

| ID | Field Name | Description/Definition | DataType | Occurrence | Pattern | Format/Values/Comments |

|---|---|---|---|---|---|---|

| 1 | ReportDate | Reported date (calendar day) for the outlier endpoint call | ISODate | Mandatory | A particular point in the progression of time in a calendar year expressed in the YYYY-MM-DD format. This representation is defined in "XML Schema Part 2: Datatypes Second Edition - W3C Recommendation 28 October 2004" which is aligned with ISO 8601. | |

| 2 | ReportTime | Reported time for the outlier endpoint call | ISOTime | Mandatory | A particular point in the progression of time in a calendar day expressed in either UTC time format (hh:mm:ss.sss), local time with UTC offset format (hh:mm:ss.sss+/-hh:mm), or local time format (hh:mm:ss.sss). These representations are defined in "XML Schema Part 2: Datatypes Second Edition - W3C Recommendation 28 October 2004" which is aligned with ISO 8601. Note on the time format: 1) beginning/end of the calendar day 00:00:00 = the beginning of a calendar day 24:00:00 = the end of a calendar day 2) fractions of second in time format Decimal fractions of seconds may be included. In this case, the involved parties shall agree on the maximum number of digits that are allowed. UTC time format (hh:mm:ss) | |

| 3 | ASPSP Brand ID | Reporting ASPSP Brand ID as defined in section 2.2. ASPSP Brand List. | Number | Mandatory | An integer value in range 1-9999. Will be extended as new Brands join Open Banking | |

| 4 | Endpoint ID | Reported EndPoint ID as defined in section 2.1 API Endpoint List. Note: ASPSPs must only report endpoints that have gone live in their systems. | Number | Mandatory | An integer value in range 1-9999. Will be extended as new endpoints are being implemented by Open Banking future standards. | |

| 5 | TTLB Response Time (Time to Last Byte) (8.6/8.7/8.8) | The Time to Last Byte (TTLB) response time for the API endpoint that generated an outlier from the overall data set of TTLB response times (e.g. a Get Account Transactions Request generates a Get Account Transactions Response message with response time being an outlier). Please note that as per the current definitions, the metric to be used for identifying the outlier will be the value of the TTLB response. This is because the TTLB time includes the TTFB time as per the definitions used in the context of OBIE reporting and thus most probably would cover the cases where TTFB would also be an outlier. Time to Last Byte (TTLB) is defined in the context of the OBIE reporting template as the total time taken for an API endpoint call to generate a response message and provide to AISPs, PISPs or CBPIIs all the information as required as defined in 36(1)(a), 36(1)(b), 36(1)(c) of the RTS and 66(4)(b), 65(3) of the PSD2. The response time clock should start at the point the endpoint call is fully received by the ASPSP and should stop at the point the last byte of the response message is transmitted to the AISP, PISP, or CBPII. The response time must be reported in milliseconds. | Number | Mandatory | Integer number with value >=0 Values in milliseconds Conditions 1. TTLB >= TTFB Cross-Table Condition with table Performance and Availability (P & A) TTLB of outlier endpoint > median TTLB for this endpoint for the day (as reported in Table Performance and Availability (P & A) | |

| 6 | TTFB Response Time (Time to First Byte) (8.9) | The Time to First Byte (TTFB) response time for the API endpoint that generated an outlier from the overall data set of TTLB response times (e.g. a Get Account Transactions Request generates a Get Account Transactions Response message with response time being an outlier). Time to First Byte (TTFB) is defined in the context of the OBIE reporting template as the total time taken for an API endpoint call to generate a response message and start providing to AISPs, PISPs or CBPIIs all the information as required as defined in 36(1)(a), 36(1)(b), 36(1)(c) of the RTS and 66(4)(b), 65(3) of the PSD2. The response time clock should start at the point the endpoint call is fully received by the ASPSP and should stop at the point the first byte of the response message is transmitted to the AISP, PISP, or CBPII. The response time must be reported in milliseconds. | Number | Mandatory | Integer number with value >=0 Values in milliseconds Conditions 1. TTLB >= TTFB | |

| 7 | TPP Application ID | This is the unique ID assigned to a TPP during their registration with the OBIE Directory for a specific application. This is the field 'software_id; in the Software Statement Assertion (SSA). It is this TPP application that made the API endpoint call that generated the outlier. | Max16Text | Mandatory | ||

| 8 | ResponsePayload Size | The value of the Response Payload for the API endpoint that generated the outlier (e.g. a Get Account Transactions Request generates a Get Account Transactions Response message with response time being an outlier) The response payload size of the response message to the supported Read/Write API endpoints must also include the size of the message headers. The Response Payload must be reported in bytes. | Number | Mandatory | Integer number with value >=0 Values in Bytes | |

| 9 | Version | The OBIE Standards version of the endpoint implementation by the ASPSP, aggregated at the level of a major or minor release, as defined in item#10 of Section 1 key usage instructions. | Max40Text | Mandatory | Allowed enumeration values: v1.0, v1.1, v2.0, v3.0, v3.1,... |

# 3.3 Auth Efficacy (OBIE)

TAB: 3. Auth Efficacy (OBIE)

| ID | Field Name | Description/Definition | DataType | Occurrence | Pattern | Format/Values/Comments |

|---|---|---|---|---|---|---|

| 1 | ReportMonth | Reported calendar month and year | Max6Text | Mandatory | ^(Jan\|Feb\|Mar\|Apr\|May\|Jun\|Jul\|Aug\|Sep\|Oct\|Nov\|Dec)\-\d{2}$ | (mmm-yy) |

| 2 | ASPSP Brand ID | Reporting ASPSP Brand ID as defined in section 2.2. ASPSP Brand List. | Number | Mandatory | Integer value in range 1-9999. Will be extended as new Brands join Open Banking | |

| 3 | Authentication Type | This is the type of authentication journeys provided by the ASPSP. It will include 'redirection' and where implemented 'decoupled' model. | Max40Text | Mandatory | Allowed enumeration values: - Redirection - Decoupled As minimum Redirection data must be provided | |

| 4 | API Type | This is the type of OBIE services that are being reported for the efficacy of the authentication journey. It includes Account Information Services (AIS), Payment Initiation Services (PIS) and Card-Based Payment Instrument Issuers (CBPIIs) | Max40Text | Mandatory | Allowed enumeration values: - AIS - PIS - CBPII | |

| 5 | API Request TPP Channel (9.12/9.20/9.27/9.34) | This is the reported TPP channel for initiating the AIs, PIS or CBPII consent. This may be provided by TPPs in the endpoint Request Header under the field 'x-customer-user-agent'. The reported value will be free format text however if populated by TPPs it will have well-known strings of characters for various popular browsers. If the string cannot be mapped to a browser, then it will probably be a mobile app. Future versions of CEG guidelines may recommend specific values to TPPs to provide in these fields some that better information is provided. | Max40Text | Mandatory | Allowed enumeration values: - Browser - Non-Browser - Unknown | |

| 6 | ASPSP Authentication Channel (9.13/9.21/9.28/9.35) | This is the reported ASPSP Authentication channel. I can be web-based (Web) or using the mobile banking app (App) | Max40Text | Mandatory | Allowed enumeration values: - Web - App - Unknown | |

| 7 | Consents requiring Authentication (9.12/9.20/9.27/9.34) (9.13/9.21/9.28/9.35) | The total number of PSU consents to require authentication at the ASPSP for the particular combination of authentication type, API type, TPP channel and ASPSP authentication channel. | Number | Mandatory | Integer number with value >=0 | |

| 8 | Authentications Attempted by PSUs (9.14/9.36) | The total number of authentications that have been attempted by the PSUs (not abandoned). This means that PSUs have tried to authenticate according to the authentication method required providing biometrics, username, passwords etc. | Number | Mandatory | Integer number with value >=0 Conditions 1. Consents requiring Authentication >= Authentications Attempted by PSUs 2. Consents requiring Authentication = Authentications Attempted by PSUs + Authentications Abandoned by PSUs | |

| 9 | Authentications Abandoned by PSUs (9.14/9.36) | The total number of PSU consents to require authentication that has been abandoned by the PSUs. This means that PSUs do not undertake the authentication but instead have dropped the journey (they have left, closed the web page or app or allowed the authentication page to time out). | Number | Mandatory | Integer number with value >=0 Conditions 1. Consents requiring Authentication >= Authentications Abandoned by PSUs 2. Consents requiring Authentication = Authentications Attempted by PSUs + Authentications Abandoned by PSUs | |

| 10 | Authentications Succeeded (9.15/9.22/9.29/9.37) | The total number of consents requiring authentication that have completed authentications by PSUs and the authentications have succeeded | Number | Mandatory | Integer number with value >=0 Conditions 1. Authentications Attempted by PSUs >= Authentications Succeeded 2. Authentications Attempted by PSUs = Authentications Succeeded + Authentications Failed | |

| 11 | Authentications Failed (9.16/9.23/9.30/9.37) | The total number of consents requiring authentication that have completed authentications by PSUs and the authentications have failed | Number | Mandatory | Integer number with value >=0 Conditions 1. Authentications Attempted by PSUs >= Authentications Failed 2. Authentications Attempted by PSUs = Authentications Succeeded + Authentications Failed | |

| 12 | Confirmations Required (9.17/9.24/9.31/9.38) | The total number of consents requiring authorisation, that after successful authentication, required a confirmation step. (Please refer to Section 1, item #9). | Number | Mandatory | Integer number with value >=0 Conditions 1. Authentications Succeeded >= Confirmations Required | |

| 13 | Confirmations Accepted by PSUs (9.18/9.25/9.32/9.39) | The total number of successful authentications that required a confirmation step and have been accepted by PSUs. This means that the PSU proceeded with the access request or the payment order submission and did not cancel the process. (Please refer to Section 1, item #9). | Number | Mandatory | Integer number with value >=0 Conditions 1. Confirmations Required >= Confirmations Accepted by PSUs 2. Confirmations Required = Confirmations Accepted by PSUs + Confirmations Rejected by PSUs | |

| 14 | Confirmations Rejected by PSUs (9.19/9.26/9.33/9.39) | The total number of successful authentications that required a confirmation step and have been rejected by PSUs. This means that the PSU cancelled the process and did not proceed with the access request or the payment order submission (Please refer to Section 1, item #9). | Number | Mandatory | Integer number with value >=0 Conditions 1. Confirmations Required >= Confirmations Rejected by PSUs 2. Confirmations Required = Confirmations Accepted by PSUs + Confirmations Rejected by PSUs | |

| 15 | Version | The OBIE Standards version of the implementation by the ASPSP, aggregated at the level of a major or minor release, as defined in item#10 of Section 1 key usage instructions. | Max40Text | Mandatory | Allowed enumeration values: v1.0, v1.1, v2.0, v3.0, v3.1,... |

Cross-Table Condition(s) with Table Daily Volumes (OBIE)

A. SUM of 'Consents requiring Authentication' of All Combinations = SUM ('Successful API Calls' - 'API Calls Rejected Status' + 'API Calls Not Authorised by PSU') of API Calls with IDs #1 OR #68 for all days of the reporting period for the ASPSP Brand ID, (as reported in Table Daily Volumes (OBIE)

where All combinations = (Redirection, AIS, Browser, Web), (Redirection, AIS, Browser, App), (Redirection, AIS, Non-Browser, Web), (Redirection, AIS, Non-Browser, App), (Redirection, AIS, Non-Browser, App), (Decoupled, AIS, Browser, Web), (Decoupled, AIS, Browser, App), (Decoupled, AIS, Non-Browser, Web), (Decoupled, AIS, Non-Browser, App), (Decoupled, AIS, Non-Browser, App)

B. SUM of 'Consents requiring Authentication' of All Combinations = SUM ('Successful API Calls' - 'API Calls Rejected Status' + 'API Calls Not Authorised by PSU') of API Calls with IDs #29, #33, #37, #41, #45, #49, #53, OR #64 for all days of the reporting period for the ASPSP Brand ID, (as reported in Table Daily Volumes (OBIE)

where All combinations = (Redirection, PIS, Browser, Web), (Redirection, PIS, Browser, App), (Redirection, PIS, Non-Browser, Web), (Redirection, PIS, Non-Browser, App), (Redirection, PIS, Non-Browser, App), (Decoupled, PIS, Browser, Web), (Decoupled, PIS, Browser, App), (Decoupled, PIS, Non-Browser, Web), (Decoupled, PIS, Non-Browser, App), (Decoupled, PIS, Non-Browser, App)

C. SUM of 'Consents requiring Authentication' of All Combinations = SUM ('Successful API Calls' - 'API Calls Rejected Status' + 'API Calls Not Authorised by PSU') of API Calls with IDs #60, for all days of the reporting period for the ASPSP Brand ID, (as reported in Table Daily Volumes (OBIE)

where All combinations = (Redirection, CBPII, Browser, Web), (Redirection, CBPII, Browser, App), (Redirection, CBPII, Non-Browser, Web), (Redirection, CBPII, Non-Browser, App), (Redirection, CBPII, Non-Browser, App), (Decoupled, CBPII, Browser, Web), (Decoupled, CBPII, Browser, App), (Decoupled, CBPII, Non-Browser, Web), (Decoupled, CBPII, Non-Browser, App), (Decoupled, CBPII, Non-Browser, App)

D. SUM of ('Authentications Succeeded' - 'Confirmations Required' + 'Confirmations Accepted by PSUs') of All Combinations = SUM ('Successful API Calls' - 'API Calls Rejected Status') of API Calls with IDs #1 OR #68, for all days of the reporting period for the ASPSP Brand ID, (as reported in Table Daily Volumes (OBIE)

where All combinations = (Redirection, AIS, Browser, Web), (Redirection, AIS, Browser, App), (Redirection, AIS, Non-Browser, Web), (Redirection, AIS, Non-Browser, App), (Redirection, AIS, Non-Browser, App), (Decoupled, AIS, Browser, Web), (Decoupled, AIS, Browser, App), (Decoupled, AIS, Non-Browser, Web), (Decoupled, AIS, Non-Browser, App), (Decoupled, AIS, Non-Browser, App)

E. SUM of ('Authentications Succeeded' - 'Confirmations Required' + 'Confirmations Accepted by PSUs') of All Combinations = SUM ('Successful API Calls' - 'API Calls Rejected Status') of API Calls with IDs #29, #33, #37, #41, #45, #49, #53, OR #64 for all days of the reporting period for the ASPSP Brand ID, (as reported in Table Daily Volumes (OBIE)

where All combinations = (Redirection, PIS, Browser, Web), (Redirection, PIS, Browser, App), (Redirection, PIS, Non-Browser, Web), (Redirection, PIS, Non-Browser, App), (Redirection, PIS, Non-Browser, App), (Decoupled, PIS, Browser, Web), (Decoupled, PIS, Browser, App), (Decoupled, PIS, Non-Browser, Web), (Decoupled, PIS, Non-Browser, App), (Decoupled, PIS, Non-Browser, App)

F. SUM of ('Authentications Succeeded' - 'Confirmations Required' + 'Confirmations Accepted by PSUs') of All Combinations = SUM ('Successful API Calls' - 'API Calls Rejected Status') of API Calls with IDs #60, for all days of the reporting period for the ASPSP Brand ID, (as reported in Table Daily Volumes (OBIE)

where All combinations = (Redirection, CBPII, Browser, Web), (Redirection, CBPII, Browser, App), (Redirection, CBPII, Non-Browser, Web), (Redirection, CBPII, Non-Browser, App), (Redirection, CBPII, Non-Browser, App), (Decoupled, CBPII, Browser, Web), (Decoupled, CBPII, Browser, App), (Decoupled, CBPII, Non-Browser, Web), (Decoupled, CBPII, Non-Browser, App), (Decoupled, CBPII, Non-Browser, App)

G. SUM of ('Authentications Abandoned by PSUs' + 'Authentications Failed' + 'Confirmations Rejected by PSUs') of All Combinations = SUM ('API Calls Not Authorised by PSU') of API Calls with IDs #1 OR #68, for all days of the reporting period for the ASPSP Brand ID, (as reported in Table Daily Volumes (OBIE)

where All combinations = (Redirection, AIS, Browser, Web), (Redirection, AIS, Browser, App), (Redirection, AIS, Non-Browser, Web), (Redirection, AIS, Non-Browser, App), (Redirection, AIS, Non-Browser, App), (Decoupled, AIS, Browser, Web), (Decoupled, AIS, Browser, App), (Decoupled, AIS, Non-Browser, Web), (Decoupled, AIS, Non-Browser, App), (Decoupled, AIS, Non-Browser, App)

H. SUM of ('Authentications Abandoned by PSUs' + 'Authentications Failed' + 'Confirmations Rejected by PSUs') of All Combinations = SUM ('API Calls Not Authorised by PSU') of API Calls with IDs #29, #33, #37, #41, #45, #49, #53, OR #64 for all days of the reporting period for the ASPSP Brand ID, (as reported in Table Daily Volumes (OBIE)

where All combinations = (Redirection, PIS, Browser, Web), (Redirection, PIS, Browser, App), (Redirection, PIS, Non-Browser, Web), (Redirection, PIS, Non-Browser, App), (Redirection, PIS, Non-Browser, App), (Decoupled, PIS, Browser, Web), (Decoupled, PIS, Browser, App), (Decoupled, PIS, Non-Browser, Web), (Decoupled, PIS, Non-Browser, App), (Decoupled, PIS, Non-Browser, App)

I. SUM of ('Authentications Abandoned by PSUs' + 'Authentications Failed' + 'Confirmations Rejected by PSUs') of All Combinations = SUM ('API Calls Not Authorised by PSU') of API Calls with IDs #60, for all days of the reporting period for the ASPSP Brand ID, (as reported in Table Daily Volumes (OBIE)

where All combinations = (Redirection, CBPII, Browser, Web), (Redirection, CBPII, Browser, App), (Redirection, CBPII, Non-Browser, Web), (Redirection, CBPII, Non-Browser, App), (Redirection, CBPII, Non-Browser, App), (Decoupled, CBPII, Browser, Web), (Decoupled, CBPII, Browser, App), (Decoupled, CBPII, Non-Browser, Web), (Decoupled, CBPII, Non-Browser, App), (Decoupled, CBPII, Non-Browser, App) Cross-Table Condition(s) with Table PSU Consent Adoption (OBIE)

J. SUM of ('Authentications Succeeded' - 'Confirmations Required' + 'Confirmations Accepted by PSUs') of All Combinations = 'One-off Consents' + 'Long-lived consents - Outstanding consents EoP' of API Service AIS for both Retail and Business PSUs during the reporting period for the ASPSP Brand ID, (as reported in Table PSU Consent Adoption (OBIE)

where All combinations = (Redirection, AIS, Browser, Web), (Redirection, AIS, Browser, App), (Redirection, AIS, Non-Browser, Web), (Redirection, AIS, Non-Browser, App), (Redirection, AIS, Non-Browser, App), (Decoupled, AIS, Browser, Web), (Decoupled, AIS, Browser, App), (Decoupled, AIS, Non-Browser, Web), (Decoupled, AIS, Non-Browser, App), (Decoupled, AIS, Non-Browser, App)

K. SUM of ('Authentications Succeeded' - 'Confirmations Required' + 'Confirmations Accepted by PSUs') of All Combinations = 'One-off Consents' of API Service PIS for both Retail and Business PSUs during the reporting period for the ASPSP Brand ID, (as reported in Table PSU Consent Adoption (OBIE)

where All combinations = (Redirection, PIS, Browser, Web), (Redirection, PIS, Browser, App), (Redirection, PIS, Non-Browser, Web), (Redirection, PIS, Non-Browser, App), (Redirection, PIS, Non-Browser, App), (Decoupled, PIS, Browser, Web), (Decoupled, PIS, Browser, App), (Decoupled, PIS, Non-Browser, Web), (Decoupled, PIS, Non-Browser, App), (Decoupled, PIS, Non-Browser, App)

L. SUM of ('Authentications Succeeded' - 'Confirmations Required' + 'Confirmations Accepted by PSUs') of All Combinations = 'Long-lived consents - Outstanding consents EoP' of API Service CBPII for both Retail and Business PSUs during the reporting period for the ASPSP Brand ID, (as reported in Table PSU Consent Adoption (OBIE)

where All combinations = (Redirection, CBPII, Browser, Web), (Redirection, CBPII, Browser, App), (Redirection, CBPII, Non-Browser, Web), (Redirection, CBPII, Non-Browser, App), (Redirection, CBPII, Non-Browser, App), (Decoupled, CBPII, Browser, Web), (Decoupled, CBPII, Browser, App), (Decoupled, CBPII, Non-Browser, Web), (Decoupled, CBPII, Non-Browser, App), (Decoupled, CBPII, Non-Browser, App)

# 3.4 PSU Adoption (OBIE)

TAB: 4. PSU Adoption (OBIE)

| ID | Field Name | Description/Definition | DataType | Occurrence | Pattern | Format/Values/Comments |

|---|---|---|---|---|---|---|

| 1 | ReportMonth | Reported calendar month and year | Max6Text | Mandatory | ^(Jan\|Feb\|Mar\|Apr\|May\|Jun\|Jul\|Aug\|Sep\|Oct\|Nov\|Dec)\-\d{2}$ | (mmm-yy) |

| 2 | ASPSP Brand ID | Reporting ASPSP Brand ID as defined in section 2.2. ASPSP Brand List. | Number | Mandatory | An integer value in range 1-9999. Will be extended as new Brands join Open Banking | |

| 3 | Retail/Business PSUs | This identifies Retail and Business PSUs for separate reporting. | Max40Text | Mandatory | Allowed enumeration values: - Retail - Business | |

| 4 | PSUs used AIS Services for the first time (9.9) | The number of unique PSUs (customers with one or more accounts with the ASPSP brand) who have authorised access to their account(s) to one or more AISPs for account information services for the first time during the reporting period. For the avoidance of doubt, this refers to new consent/authorisations and not re-authorisations. A PSU providing account access to more than 1 AISP should not be double-counted. For business customers, unique PSUs should refer to all employees of the business who have separate authentication credentials and can be identified separately. Multi-banked PSUs cannot be identified so they may be double-counted by different ASPSPs. | Number | Mandatory | Integer number with value >=0 | |

| 5 | PSUs used PIS Services for the first time (9.10) | The number of unique PSUs (customers with one or more accounts with the ASPSP brand) who have authorised a payment initiation of any type from any of their account(s) via one or more PISPs for the first time during the reporting period. For the avoidance of doubt, a PSU initiating a payment (e.g. single domestic) using a PISP A from a PCA A and then initiating another payment of different type (e.g. international) using a PISP B from a PCA B within the same ASPSP brand, should not be double-counted. For business customers, unique PSUs should refer to all employees of the business who have separate authentication credentials and can be identified separately. Multi-banked PSUs cannot be identified so they may be double-counted by different ASPSPs. | Number | Mandatory | Integer number with value >=0 | |

| 6 | Total PSUs used AIS Services (9.9) | The total number of unique PSUs (customers with one or more accounts with the ASPSP brand) who: a. have authorised access to their account(s) to one or more AISPs for account information services during the reporting period for the first time (see PSUs used AIS Services for the first time) b. have previously authorised access to their account(s) to one or more AISPs for account information services and had their account accessed at least once by any of the AISPs during the reporting period. c. have previously authorised access to their account(s) to one or more AISPs for account information services and had to re-authenticate to refresh the account access at least for one of the AISPs during the reporting period. For the avoidance of doubt, a PSU in case (c) re-authenticating their account access should not be double-counted if an AISP accesses their account after re-authentication. For business customers, unique PSUs should refer to all employees of the business who have separate authentication credentials and can be identified separately. | Number | Mandatory | Integer number with value >=0 Conditions 1. Total PSUs used AIS Services >= PSUs used AIS Services for the first time | |

| 7 | Total PSUs used PIS Services (9.10) | The total number of unique PSUs (customers with one or more accounts with the ASPSP brand) who: a. have authorised a payment initiation of any type from any of their account(s) via one or more PISPs for the first time during the reporting period (see PSUs used PIS Services for the first time) b. have authorised a payment initiation of any type from any of their account(s) via one or more PISPs during the reporting period and have initiated payments using PIS services before. For the avoidance of doubt, a PSU initiating a payment (e.g. single domestic) using a PISP A from a PCA A and then initiating another payment of different type (e.g. international) using a PISP B from a PCA B within the same ASPSP brand, should not be double-counted. For business customers, unique PSUs should refer to all employees of the business who have separate authentication credentials and can be identified separately. | Number | Mandatory | Integer number with value >=0 Conditions 1. Total PSUs used PIS Services >= PSUs used PIS Services for the first time | |

| 8 | Unique PSUs used both AIS and PIS Services for the first time | PSUs accessing both AIS and PIS services using the same authentication credentials. The number of unique PSUs (customers with one or more accounts with the ASPSP brand) who have: a. authorised access to their account(s) to one or more AISPs for account information services for the first time during the reporting period. AND b. authorised a payment initiation of any type from any of their account(s) via one or more PISPs for the first time during the reporting period. For the avoidance of doubt: i. for AIS, this refers to new consent/authorisations and not re-authorisations. A PSU providing account access to more than 1 AISPs should not be double-counted. For business customers, unique PSUs should refer to all employees of the business who have separate authentication credentials and can be identified separately. ii. for PIS, a PSU initiating a payment (e.g. single domestic) using a PISP A from a PCA A and then initiating another payment of different type (e.g. international) using a PISP B from a PCA B within the same ASPSP brand, should not be double-counted. For business customers, unique PSUs should refer to all employees of the business who have separate authentication credentials and can be identified separately. | Number | Mandatory | Integer number with value >=0 Conditions 1. Unique PSUs used both AIS and PIS Services for the first time <= PSUs used AIS Services for the first time 2. Unique PSUs used both AIS and PIS Services for the first time <= PSUs used PIS Services for the first time 3. Unique PSUs used both AIS and PIS Services for the first time <= PSUs used AIS Services for the first time + PSUs used PIS Services for the first time | |

| 9 | Total unique PSUs used both AIS and PIS Services | PSUs accessing both AIS and PIS services using the same authentication credentials. The total number of unique PSUs (customers with one or more accounts with the ASPSP brand) who: a. have authorised access to their account(s) to one or more AISPs for account information services during the reporting period for the first time (see PSUs used AIS Services for the first time) b. have previously authorised access to their account(s) to one or more AISPs for account information services and had their account accessed at least once by any of the AISPs during the reporting period. c. have previously authorised access to their account(s) to one or more AISPs for account information services and had to re-authenticate to refresh the account access at least for one of the AISPs during the reporting period. AND d. have authorised a payment initiation of any type from any of their account(s) via one or more PISPs for the first time during the reporting period (see PSUs used PIS Services for the first time) e. have authorised a payment initiation of any type from any of their account(s) via one or more PISPs during the reporting period and have initiated payments using PIS services before. For the avoidance of doubt: i. For AIS, a PSU in case (c) re-authenticating their account access should not be double-counted if an AISP accesses their account after re-authentication. For business customers, unique PSUs should refer to all employees of the business who have separate authentication credentials and can be identified separately. ii. For PIS, a PSU initiating a payment (e.g. single domestic) using a PISP A from a PCA A and then initiating another payment of different type (e.g. international) using a PISP B from a PCA B within the same ASPSP brand, should not be double-counted. For business customers, unique PSUs should refer to all employees of the business who have separate authentication credentials and can be identified separately. | Number | Mandatory | Integer number with value >=0 Conditions 1. Total unique PSUs used both AIS and PIS Services >= Unique PSUs used both AIS and PIS Services for the first time 2. Total unique PSUs used both AIS and PIS Services <= Total PSUs used AIS Services 3. Total unique PSUs used both AIS and PIS Services <= Total PSUs used PIS Services 4. Total unique PSUs used PIS Services <= Total PSUs used AIS Services + Total PSUs used PIS Services | |

| 11 | Total new PSUs for Online Banking | The number of unique PSUs (customers with one or more accounts with the ASPSP brand) who have been granted access to the Online Banking for the first time. | Number | Mandatory | Integer number with value >=0 | |

| 12 | Total new PSUs for Mobile Banking | The number of unique PSUs (customers with one or more accounts with the ASPSP brand) who have been granted access to the Mobile Banking for the first time. | Number | Mandatory | Integer number with value >=0 | |

| 13 | Total number of PSUs used Online Banking | The total number of unique PSUs (customers with one or more accounts with the ASPSP brand) who have used the Online Banking service for either accessing account information or initiating a payment. Note: For business customers, unique PSUs should refer to all employees of the business who have separate authentication credentials and can be identified separately. | Number | Mandatory | Integer number with value >=0 Conditions 1. Total number of PSUs used Online Banking >= Total new PSUs for Online Banking | |

| 14 | Total number of PSUs used Mobile Banking | The total number of unique PSUs (customers with one or more accounts with the ASPSP brand) who have used the Mobile Banking service for either accessing account information or initiating a payment. Note: For business customers, unique PSUs should refer to all employees of the business who have separate authentication credentials and can be identified separately. | Number | Mandatory | Integer number with value >=0 Conditions 1. Total number of PSUs used Mobile Banking >= Total new PSUs for Mobile Banking | |

| 15 | Version | The OBIE Standards version of the implementation by the ASPSP, aggregated at the level of a major or minor release, as defined in item#10 of Section 1 key usage instructions. The reporting of this item is optional. | Max40Text | Optional | Allowed enumeration values: v1.0, v1.1, v2.0, v3.0, v3.1,... |

# 3.4-A Enhanced PSU Adoption (OBIE)

TAB: 4-A. Enhanced PSU Adoption (OBIE)

| ID | Field Name | Description/Definition | DataType | Occurrence | Pattern | Format/Values/Comments |

|---|---|---|---|---|---|---|

| 1 | ReportMonth | Reported calendar month and year | Max6Text | Mandatory | ^(Jan\|Feb\|Mar\|Apr\|May\|Jun\|Jul\|Aug\|Sep\|Oct\|Nov\|Dec)\-\d{2}$ | (mmm-yy) |

| 2 | ASPSP Brand ID | Reporting ASPSP Brand ID as defined in section 2.2. ASPSP Brand List. | Number | Mandatory | Integer value in range 1-9999. Will be extended as new Brands join Open Banking | |

| 3 | Retail/Business PSUs | This identifies Retail and Business PSUs for separate reporting. | Max40Text | Mandatory | Allowed enumeration values: - Retail - Business | |

| 4 | API Service | This identifies the API service the PSU is using, including Account Information (AIS), Payment Initiation (PIS) and Card-Based Payment Instrument Issuers (CBPII). Each service must be reported separately and also all the possible combinations of services a PSU maybe using offered by the ASPSP. The PSUs reported for each type of API service combination are distinct users in order to avoid double counting. | Max40Text | Mandatory | Allowed enumeration values: AIS_only PIS_only CBPII_only AIS_&PIS AIS&CBPII PIS&CBPII AIS&PIS&_CBPII | |

| 5 | Active PSUs | This is the total number of bank-level PSUs (i.e. the number of customers that give access to accounts for each of the API service combinations). For the avoidance of doubt, this includes all customers (consumers and account holders of SME businesses) who; For AIS_only API service: Have an active long-lived AIS consent at the end of the reporting period OR Have provided a one-off AIS consent during the current reporting period OR Have both an active AIS consent at the end of the reporting period AND have provided a one-off AIS consent during the current reporting period (These must be counted as one PSU). For PIS_only API s service: 4. Have provided a one-off PIS consent during the current reporting period (payment initiation instruction). For CBPII_only service: 5. Have an active CBPII/CoF consent at the end of the reporting period. For AIS_&PIS service: 6. Have performed a combination of rules 1. to 3. AND rule 4. (These must be counted as one PSU) For AIS&CBPII service: 7. Have performed a combination of rules 1. to 3. AND rule 5. (These must be counted as one PSU) For PIS&CBPII service: 8. Have performed a combination of rule 4. AND 5. (These must be counted as one PSU) For AIS_PIS&_CBPII service: 9. Have performed a combination of rules 1. to 3. AND rule 4. AND rule 5.(These must be counted as one PSU) | Number | Mandatory | Integer number with value >=0 AIS_only Active PSUs + PIS_only Active PSUs + CBPII_only Active PSUs + AIS_&PIS Active PSUs + AIS&CBPII Active PSUs + PIS&CBPII Active PSUs + AIS&PIS&_CBPII Active PSUs = Total Active PSUs within ASPSP (unique) | |

| 6 | Active SME Businesses | This is the total number of bank-level SME Business PSUs (i.e. the number of SME business customers that consented to give access to their accounts for each of the API service combinations). For the avoidance of doubt, this is referring to the number of SME businesses which have consented and not the number of users of these businesses that have account access credentials to the businesses' accounts and have consented. ASPSP should use their own definition of SME business (e.g. level of turnover). | Max20AlphaNumericTex | Mandatory | Integer number with value >=0 If Retail/Business PSUs is 'Retail': NULL For Business PSUs, if Active PSUs >0 then Active SME Businesses >0 For Business PSUs, if Active SME Businesses >0, then Active PSUs >0 | |

| 7 | Version | The OBIE Standards version of the implementation by the ASPSP, aggregated at the level of a major or minor release, as defined in item#10 of Section 1 key usage instructions. The reporting of this item is optional. | Max40Text | Optional | Allowed enumeration values: v1.0, v1.1, v2.0, v3.0, v3.1,... |

Notes:

Duplication challenges in counting bank-level PSUs.

In order to ease the computational burden on ASPSPs, it is proposed that they do not undertake de-duplication effort across brands and product types such as PCA, BCA and Credit cards (if the credit card associated consents cannot be easily filtered out). Please refer to the following rules:

Duplication of PSUs Rules:

- More than one brand: If an individual customer has accounts and provided access authorisation to more than one ASPSP brand of the same ASPSP Group, then the ASPSP Group is allowed to count the individual customer as multiple bank-level PSUs. This means that ASPSPs Groups do not need to de-duplicate across ASPSP brands, providing ease of computation.

- More than one product (e.g. PCA and BCA and credit card): if an individual customer has more than one account product and provided access authorisation for each of them to the ASPSP, then the ASPSP is allowed to count the individual customer as multiple bank-level PSUs. This means that ASPSPs do not need to de-duplicate across products, providing ease of computation.

- Joint Account: All members of a joint account who have consented are allowed to be counted as multiple bank-level PSUs.

However,

- If a PSU has provided consent to multiple TPPs for the same account type (e.g. current account) in an ASPSP, then the ASPSP must count the PSU as one PSU.

- If a PSU has provided consent to any combination of the API services of AIS, PIS or CBPII for the same account type (e.g. current account) in an ASPSP, then the ASPSP must count the PSU as one PSU.